Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

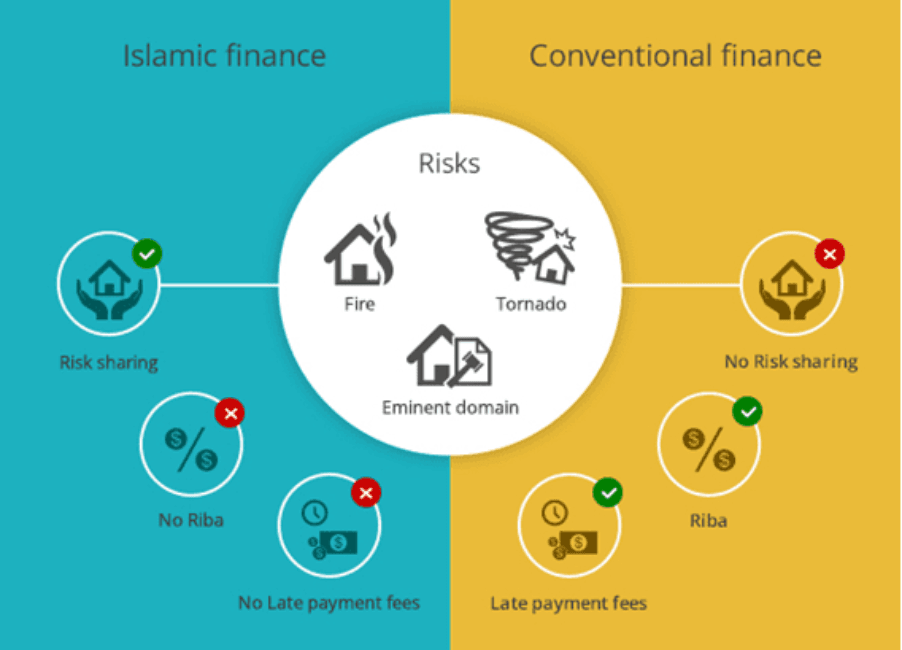

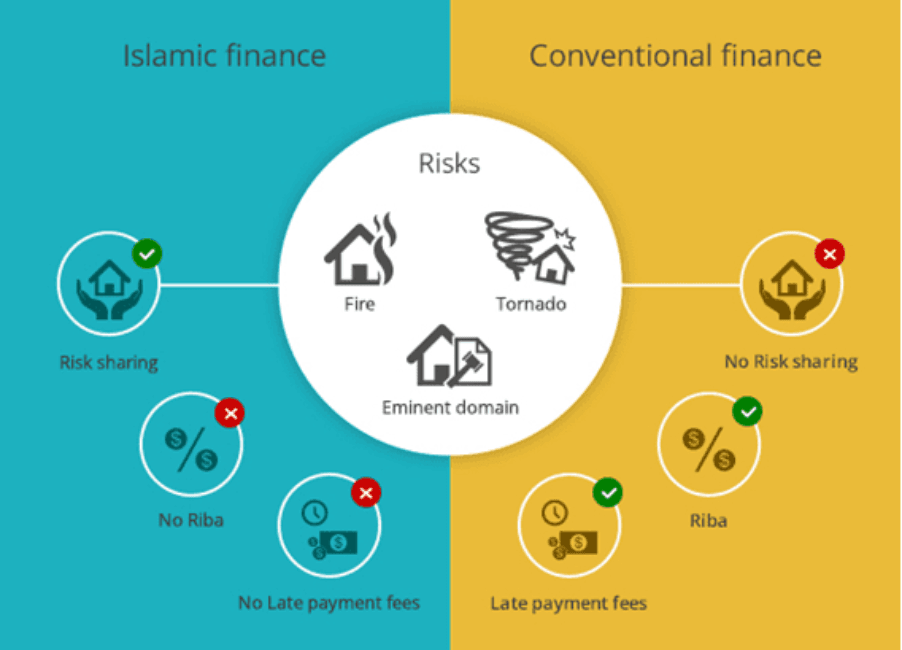

Islamic finance, a rapidly growing sector of the global financial landscape, offers a unique approach to economic activity. Rooted in Islamic law (Sharia), it provides a framework for financial transactions that prioritizes ethical considerations, social responsibility, and fairness. Unlike conventional finance, which often focuses solely on profit maximization, Islamic finance emphasizes adherence to a set of core principles that guide all financial dealings. These principles, often referred to as the five pillars of Islamic finance, form the bedrock of this system and distinguish it from traditional financial practices. Understanding these pillars is crucial for anyone seeking to engage with or learn more about this increasingly important field. This exploration will delve into each of these pillars, examining their meaning, implications, and significance within the broader context of Islamic finance.

The five pillars are not merely abstract concepts; they are practical guidelines that shape the structure and operation of Islamic financial institutions and products. They ensure that financial activities are not only profitable but also contribute to a just and equitable society.

Riba, often translated as “usury” or “interest,” is perhaps the most well-known principle of Islamic finance. It strictly prohibits the charging or paying of interest on loans or debts. This prohibition stems from the belief that money itself should not generate more money without a corresponding effort or risk. Instead of interest-based transactions, Islamic finance offers alternative financing methods such as Murabaha (cost-plus financing), where the price of an asset is marked up to include a profit margin, and Ijara (leasing), where an asset is leased for a fixed period. These methods facilitate trade and investment without resorting to interest-based lending. The avoidance of riba is central to the ethical foundation of Islamic finance, promoting fairness and discouraging exploitative lending practices.

Gharar refers to excessive uncertainty or ambiguity in a contract or transaction. It encompasses situations where the subject matter of the contract, the price, or the terms of delivery are not clearly defined, leading to potential disputes and unfair outcomes. Islamic finance emphasizes transparency and clarity in all dealings. Contracts must be free from excessive uncertainty to ensure that all parties involved have a clear understanding of their rights and obligations. This principle protects against speculative transactions where the outcome is highly uncertain and potentially detrimental to one or more parties. By minimizing gharar, Islamic finance promotes stability and reduces the risk of disputes.

Maysir encompasses gambling and speculative activities that involve a high degree of chance or risk. These activities are considered unethical in Islamic finance because they rely on speculation and can lead to unjust enrichment. Islamic finance prohibits investments in businesses or ventures that are primarily based on gambling or speculation. This principle encourages investment in real assets and productive activities that contribute to the real economy, rather than purely speculative ventures that can create financial instability. The avoidance of maysir promotes a more responsible and sustainable approach to finance.

Islamic finance extends beyond purely financial mechanisms to encompass the ethical and moral dimensions of business activities. It prohibits investments in businesses that deal in haram (forbidden) goods and services, such as alcohol, pork, gambling, pornography, and weapons manufacturing. This principle ensures that financial activities are aligned with Islamic values and contribute to the betterment of society. It encourages investment in businesses that produce and distribute halal (permissible) goods and services that are beneficial to individuals and communities. This ethical screening of investments is a crucial aspect of Islamic finance, ensuring that financial activities are not only profitable but also morally sound.

The overarching principle that underpins all other pillars of Islamic finance is the emphasis on justice and equity. Islamic finance seeks to promote fairness and balance in all financial transactions. Contracts and agreements must be fair and equitable, and should not exploit or disadvantage any party. This principle encourages ethical behavior and promotes social responsibility. It emphasizes the importance of considering the broader impact of financial activities on society and encourages investments that benefit the community as a whole. The pursuit of justice and equity is not just a moral imperative; it is also seen as essential for long-term economic stability and prosperity.

These five pillars are not merely theoretical constructs; they have practical implications for the design and implementation of Islamic financial products and services. They provide a framework for ensuring that financial activities are conducted in a morally and ethically sound manner. By adhering to these principles, Islamic finance aims to promote:

The five pillars of Islamic finance provide a comprehensive ethical framework for financial transactions. They offer an alternative to conventional finance, emphasizing ethical considerations, social responsibility, and fairness. By understanding and adhering to these principles, individuals and institutions can engage in responsible and ethical financial practices that align with Islamic values and contribute to a just and equitable society. While this overview provides a foundational understanding, it is crucial to consult with qualified Islamic scholars and financial experts for specific guidance on complex financial matters. The field of Islamic finance is constantly evolving, and ongoing research and dialogue are essential for its continued development and contribution to the global financial system.