Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Financial planning is an essential aspect of a balanced and fulfilling life, and Islam places significant emphasis on its importance. Islamic teachings provide a comprehensive framework for responsible financial management, encouraging virtues such as saving, budgeting, avoiding excessive debt, and contributing to the well-being of the community. It’s not just about accumulating wealth; it’s about managing resources in a way that aligns with Islamic principles and contributes to both worldly and spiritual success. This guide explores the key principles of Islamic financial planning and offers practical tips for Muslims seeking to manage their finances responsibly.

Islamic financial planning is grounded in a set of core principles that guide all financial decisions. These principles are not merely suggestions; they are integral to living a life in accordance with Islamic values.

Muslims are encouraged to view wealth as a trust from Allah, a gift to be used responsibly and in accordance with His guidance. This concept of stewardship emphasizes that we are not absolute owners of our wealth but rather custodians entrusted with its management. It encourages humility and discourages arrogance or greed in the pursuit of wealth.

Islam discourages excessive spending and encourages moderation in all aspects of life, including financial matters. This principle promotes balance between fulfilling worldly needs and prioritizing spiritual growth. It emphasizes the importance of avoiding extravagance and unnecessary consumption, focusing instead on fulfilling essential needs and giving back to the community.

Saving for the future is highly encouraged in Islam as a means of preparing for unexpected expenses, emergencies, and future needs, such as retirement, education, or Hajj. Saving is not just about accumulating wealth; it’s about ensuring financial security and providing for oneself and one’s family.

Charging or paying interest (riba) on loans is strictly prohibited in Islam. This prohibition is based on the belief that interest-based transactions are unjust and exploitative. Islamic finance offers alternative, Sharia-compliant financing methods that avoid riba, such as profit-sharing, joint ventures, and cost-plus financing.

Paying Zakat, a portion of one’s eligible wealth to those in need, is a fundamental pillar of Islam. It is not just an act of charity; it is a religious obligation that purifies wealth and promotes social justice. Zakat helps to redistribute wealth within the community and provides support for the less fortunate.

While debt may be permissible in certain circumstances, Islam encourages individuals to avoid excessive debt and strive for financial independence. This principle emphasizes the importance of living within one’s means and avoiding financial burdens that can hinder one’s ability to fulfill other obligations.

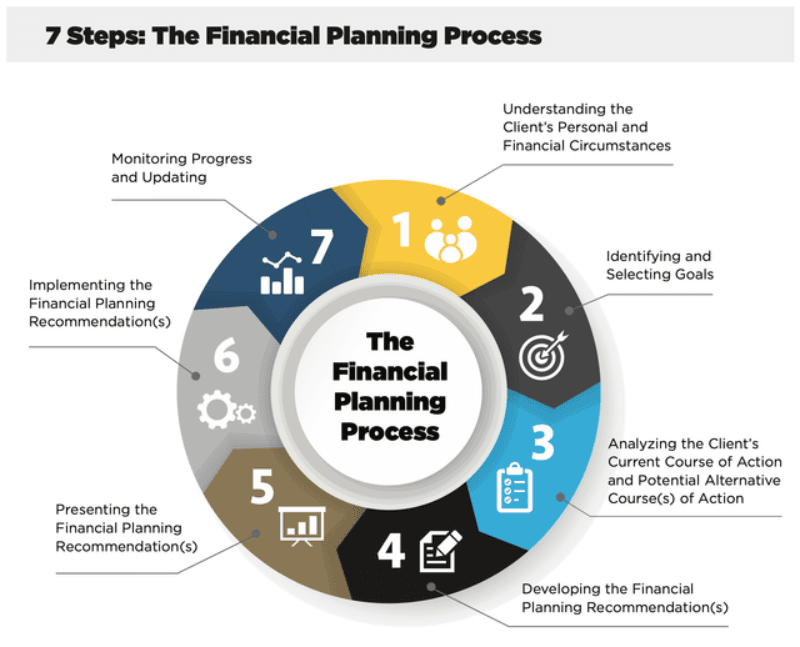

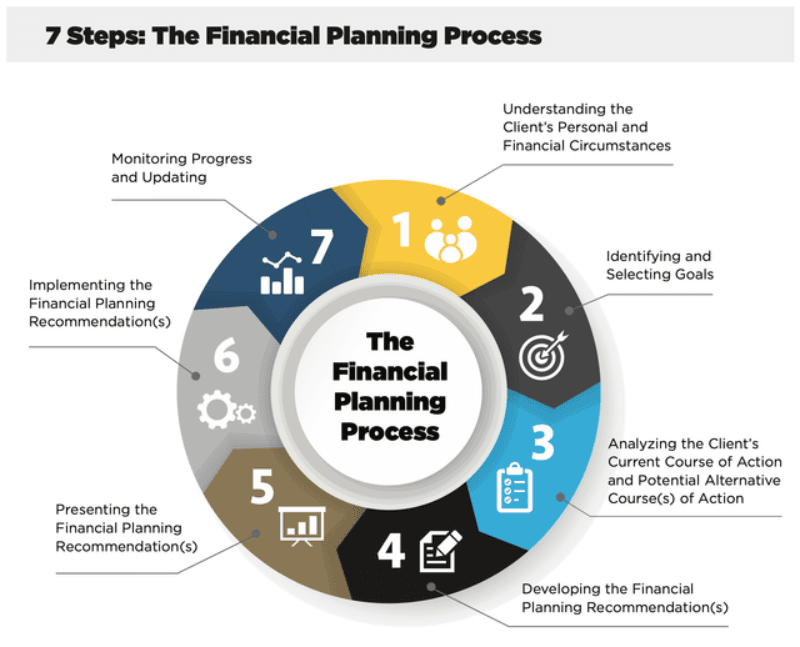

Putting Islamic financial principles into practice requires careful planning and consistent effort. Here are some practical tips to help you manage your finances in accordance with Islamic teachings:

Develop a realistic budget that tracks your income and expenses, ensuring that your spending aligns with Islamic principles and your financial goals. A budget allows you to monitor your spending habits, identify areas where you can save, and prioritize essential needs over unnecessary wants.

Establish clear financial goals, such as saving for Hajj, purchasing a home, providing for your family’s education, or supporting charitable causes. Having specific goals gives you direction and motivation in your financial planning.

Explore halal investment options that comply with Islamic principles, such as ethical investing, socially responsible investing, and investments in Sharia-compliant funds. Avoid investments in industries that are prohibited in Islam, such as alcohol, gambling, or weapons manufacturing.

Refrain from engaging in any financial activities that are prohibited in Islam, such as gambling, speculation, and usury. These activities are considered unethical and can lead to financial ruin.

Consult with financial advisors who specialize in Islamic finance for personalized guidance and support. They can help you develop a comprehensive financial plan that aligns with your individual circumstances and Islamic principles.

Sound financial planning, guided by Islamic principles, offers numerous benefits in this world and the hereafter.

Proper financial planning provides peace of mind and security for individuals and families, allowing them to weather unexpected financial storms and plan for the future with confidence.

Adhering to Islamic financial principles helps fulfill religious obligations, such as paying Zakat and avoiding riba, contributing to spiritual growth and a sense of purpose.

By giving back to the community through Zakat and other charitable activities, individuals can contribute to social and economic development, helping to build a stronger and more equitable society.

Responsible financial management fosters self-discipline, patience, and a sense of contentment, contributing to personal and spiritual growth.

Islamic financial planning is a holistic approach to managing wealth that integrates financial strategies with Islamic principles and values.

By embracing these principles, individuals can achieve financial stability, fulfill their religious obligations, contribute to the well-being of their community, and attain spiritual growth. It’s a path to both worldly prosperity and eternal success. Remember that this blog post provides a general overview. It is essential to consult with qualified Islamic scholars and financial experts for personalized guidance and advice tailored to your specific circumstances.