Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Technology has fundamentally reshaped the global business landscape, and its influence on Islamic business is profound. From the rise of e-commerce and social media marketing to the emergence of fintech and artificial intelligence, technology presents both significant opportunities and unique challenges for Muslim entrepreneurs seeking to grow their businesses while adhering to their faith. This exploration will delve into the transformative impact of technology on Islamic business, examining both the advantages it offers and the ethical considerations that must be addressed.

Technology has unlocked a wealth of opportunities for Islamic businesses, enabling them to expand their reach, improve efficiency, and enhance their operations in ways previously unimaginable.

Online platforms and e-commerce have democratized access to global markets, allowing businesses of all sizes to connect with customers worldwide. This expanded reach enables Islamic businesses to tap into a broader customer base, transcending geographical limitations and fostering international trade within the Muslim community and beyond.

Technology has streamlined various business operations, from inventory management and supply chain logistics to customer service and communication. Automation, data analytics, and integrated software solutions have increased efficiency and productivity, allowing businesses to optimize their resources and focus on strategic growth.

Technology can enhance transparency and accountability in business transactions, fostering trust and ethical practices. Blockchain technology, for example, can be used to track products throughout the supply chain, ensuring halal compliance and building consumer confidence. This transparency reinforces the ethical foundations of Islamic business.

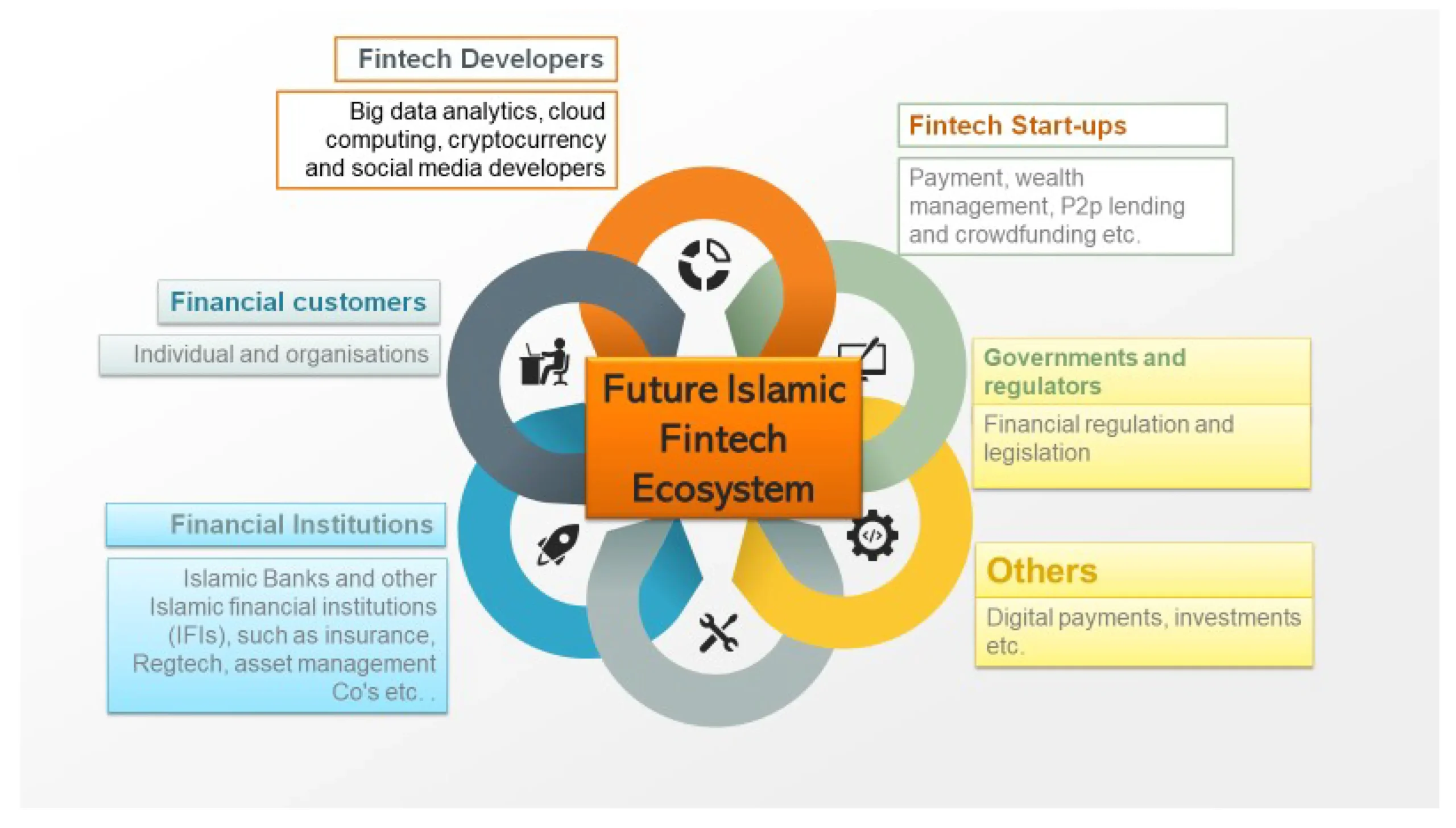

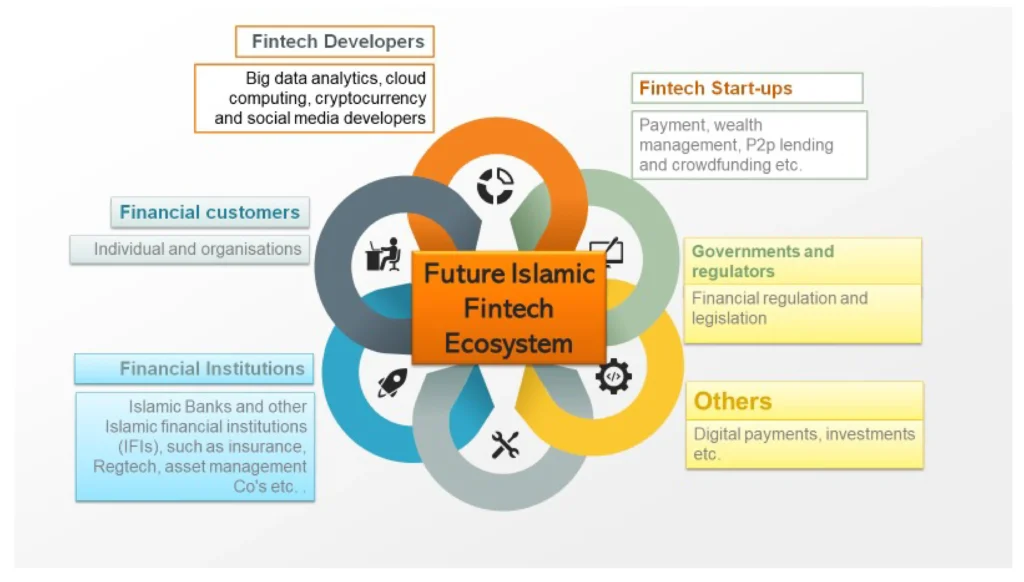

Fintech solutions, such as Islamic digital banking and mobile payment platforms, have the potential to improve access to financial services for underserved communities, particularly in regions where traditional banking infrastructure is limited. These innovative solutions can empower individuals and businesses, fostering financial inclusion and economic development within the framework of Islamic finance.

Technology fosters innovation and entrepreneurship by providing new tools and platforms for businesses to thrive. Online marketplaces, crowdfunding platforms, and digital marketing tools empower entrepreneurs to launch and scale their businesses more easily than ever before. This creates a dynamic environment for innovation and growth within the Islamic business sector.

The impact of technology on Islamic business can be seen in a variety of innovative applications:

While technology offers immense opportunities, it also presents certain challenges and ethical considerations that Islamic businesses must address.

Protecting sensitive customer data and ensuring the ethical use of technology are crucial considerations. Businesses must implement robust data privacy and security measures to comply with regulations and maintain customer trust.

Ensuring equitable access to technology and digital literacy for all members of the Muslim community is essential. Efforts must be made to bridge the digital divide and provide access to technology and training for underserved populations.

Protecting businesses from cyber threats, such as hacking and data breaches, is paramount. Businesses must invest in cybersecurity measures to safeguard their data and systems from malicious attacks.

Utilizing technology in a manner that aligns with Islamic values is crucial. This includes avoiding deception, promoting transparency, respecting privacy, and ensuring fairness in all online interactions.

Technology presents both exciting opportunities and unique challenges for Islamic businesses. By embracing technology responsibly and ethically, Muslim entrepreneurs can leverage its power to build successful businesses, contribute to economic growth, and promote social good within their communities. It’s a matter of harnessing innovation while staying true to the ethical principles that underpin Islamic business. This requires a proactive approach, careful planning, and a commitment to ethical practices in the digital realm.